Steps to building a financially strong operation

It’s easy to lump farm accounting and farm finance together. Reasonably so, as both are necessary ingredients in building a financially viable farming operation. But each has its distinct role in building financial strength.

Many people view farm accounting as the necessary process of capturing and categorizing transactions for financial statements and income tax preparation purposes. But farm accounting also serves a far more reaching purpose: it’s the basis/foundation necessary to analyze your farm’s finances.

In other words, farm accounting can exist on its own, but farm finance is entirely dependent upon a sound farm accounting system to provide the necessary and accurate data to analyze.

Farm accounting is looking at and capturing your past, while farm finance is understanding your current position to project and drive a better future. Farm accounting is a science. It’s a precise method to get specific results — financial statements and a Schedule F.

Farm finance is part science, part art. There are precise methods, but each result must be pieced together with the others to get a clearer picture of your operation.

Farm finance is analyzing your numbers in multiple ways so you truly understand your business. By taking a deeper, more focused look at individual areas, you’ll gain greater insight into your operation’s strengths and weaknesses, allowing you to make the adjustments necessary to build financial agility and resiliency into your operation.

Begin with a strong foundation

Start with a robust, farm-specific accounting system.

Many farmers have tended to go with a version of Quickbooks. But we know this generic software doesn’t meet a farmer’s unique needs. If you’re still relying on it, you’re also missing out on technological advances that do the work for you. Created specifically for farmers, Traction Ag’s cloud-based farm accounting software seamlessly connects to your field records (JD Operations & Climate Fieldview) to provide you with key information, such as your production costs, enterprise profitability, and even field-level profitability.

Unlike QB, it also tracks your supply and crop inventories and investments in growing crops providing access to your accurate accrual income and earned net worth. Download the eBook to learn more.

Measure where you are now.

Along with monitoring the critical information discussed above, use the ratio calculations from a farm financial scorecard to dive deeper into your operation’s strengths and weaknesses. It will help you understand your operation’s ability to pay its debts, both in the short and long term, and provide multiple looks at the efficiency with which you operate.

Track these ratios over time to measure your progress in building financial strength.

Use benchmarks to help you evaluate

Besides the scorecard, you can compare yourself to similar operations. Using a land-grant university database such as FINBIN allows you to compare your ratios, revenues, and costs against similar farms. Use these comparisons to further identify opportunities and threats to your operation.

Do an honest assessment

Armed with this information, reflect on your current position. Do you have problem areas? If so, what could help you address them? Ask such questions as:

- Can I restructure my loans to reduce my payments?

- Are there unneeded assets I can sell?

- Can I reduce family living expenses?

- What can I do to increase profitability? Off-farm income? Specialty crops?

- Are there jobs I’m hiring for that I could do myself to control costs?

- Can I delay asset purchases?

Does your information show you are on solid ground?

If so, keep monitoring to ensure complacency doesn’t set in. Keep your working cash, family living expenses, and costs under control, and carefully evaluate any equipment purchases. Depending on your strength, it may be time to consider profitable farm or non-farm investments.

Adjust and monitor your budget

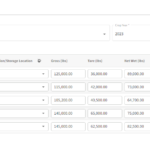

Based on your assessment, build feasible changes into your budget. Then at a minimum, compare your actual cash flow with what you budgeted monthly. Dig into the reasoning for any significant changes to foresee and head off future challenges.

Stress test your budget

Some variables in your operation are outside of your control. Crop prices, yield reduction from weather, and increasing interest rates are a few. Stress testing involves changing one or more of these variables in your budget to see what effect it would have on your cash flow, profitability, and balance sheet. Test your budget to see the results if your crop price dropped a dollar. What about two dollars? Or gauge the impact if your average yield decreased 10 percent. What about 20 percent? What happens if your operating loan interest increased 1 percent? This process allows you to assess your vulnerabilities and take a proactive approach to your risk management.

Farming for the future

Building a financially strong farm doesn’t happen overnight. Make your finances a priority by committing to a rugged accounting solution today so you have the data you need to build a better tomorrow. The farm landscape is in the midst of a big change. Opportunities will present themselves. Ensure you have the business and financial IQ to capitalize on them.

-

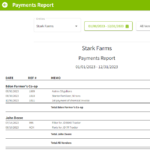

Brian Stark

Brian Stark is the Product Marketing Director for Traction Ag, based in Auburn, Indiana. Prior to co-founding the company in 2020, he led the sales and marketing efforts at Farm Works Software for 14 years and was part of Trimble’s marketing and communications team for 10 years. He completed his undergraduate degree from The Ohio State University in Agribusiness. Brian and his wife, Kimberly, own a Centennial Farm in Edgerton, Ohio, and have three children.