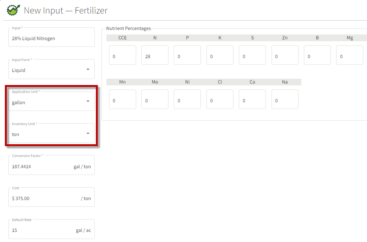

April 2024 Feature Release

Our April feature release addresses inputs (fertilizers & chemicals), specifically when you have a different inventory form than the application rate.

Prepping Farm Financials for the Harvest Season

As the harvest season approaches, it’s crucial for grain farmers to not only ready their equipment but also streamline their financial strategies for a prosperous 2024.

Traction Payroll Coming Soon

DO YOU NEED FARM PAYROLL FOR 2022? We know payroll…