The Right tool for the right job

A long-time user of QuickBooks, farmer Chad Everetts recently switched to Traction for better inventory tracking and field profit center reports.

As a farmer, you know that having the right tool at the right time is vital for your operation. Would you use a screwdriver to replace a tire? Not likely, so why would you use accounting software that isn’t tailor made for your farm? If you find yourself using QuickBooks®, it’s time to consider other options to better position your farm for the future.

As a certified public accountant (CPA) and farmer, Brian Thompson is familiar with the nuances of farm accounting and how vital it is to use an industry-specific accounting program, like Traction Accounting. Thompson is familiar with a variety of accounting programs, including Quickbooks, Farm Works and Traction.

Launched in 1983, QuickBooks is an iconic name in the financial management software arena. While QuickBooks products are geared toward businesses, those involved in agriculture know that farm accounting is unique.

“They tried to design QuickBooks to be applicable to all types of businesses, they have payroll, sales tax, invoicing and other things that farmers may not need at the start,” Thompson says. “It seems like if farmers don’t set up QuickBooks correctly out of the gate, sometimes they struggle with it. And if they don’t have a pretty significant accounting background or experience, they struggle to grasp some of the things you do in QuickBooks.”

The Entity Dilemma

For farms with multiple entities, like Thompson, having separate logins and separate subscriptions for each business is another downfall of QuickBooks Online. Thompson does the bookkeeping for both of his family’s farming entities as well as he and his dad’s personal books.

“If I try to do all that in QuickBooks Online, I’d be up to four different subscriptions a month, and that would add up in a hurry with the multiple entities,” he says. “That’s one of the big benefits of Traction over QuickBooks.”

Traction’s Basic Accounting software allows you to create an unlimited number of entities that can be separated or combined for tax reporting. While most other accounting systems charge for multiple entities, Traction doesn’t.

Traction can handle multiple business entities for separate or combined reporting.

Thompson started using Traction in mid-2021 and has been very impressed with Traction’s capabilities thus far. “The amount of improvements and upgrades over the past year is pretty incredible,” Thompson says. “That’s the great thing about cloud-based versus desktop solutions. Cloud-based is continuously improving rather than one big update a year for your desktop product,” he adds. “It’s a lot faster to change, which is definitely needed now with the way things operate.”

A fully integrated farm management software solution, Traction can integrate your accounting, payroll, field operations and agronomy into one platform, but you only pay for the features you need for your operation.

“I really like the fact that if you don’t need payroll, you don’t pay for payroll. You don’t buy it, it’s not there. You don’t have to worry about stuff like that where you can get confused with something you don’t even use,” Thompson says. “With Traction, you can start with the basic stuff and then add on whatever you need later and pay for the extra features at that time.”

Better Inventory management

Everetts appreciates how Traction Accounting handles product inventories from field to field.

Ohio grain farmer Chad Everetts was a long-time QuickBooks user before he switched to Traction last year. Finding the right tool for his recordkeeping has made a world of difference for Everetts.

“Using Traction, I’ve been able to track my product inventory from field to field, and with QuickBooks, I wasn’t able to do that,” he says. “It’s been a fun transition and saved me a bunch of time.”

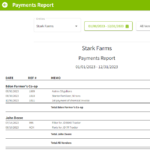

When it came to preparing his taxes, Everetts liked how easy it was to share his Traction accounting records with his accountant. “My CPA can have an extra set of eyes to look at it, along with my Traction team and myself,” he explains.

Whether you’re a long-time QuickBooks user like Everetts or you’ve been using another software and you’re looking for a change, Traction is definitely a great fit for any operation looking to get more from their farm accounting.

-

Jessie Topp Becker

Growing up actively involved in my family's diversified crop and beef cattle operation cultivated my passion in agriculture from an early age. My exceptional written and verbal communication skills were developed through participation in various 4-H and FFA activities, as well as my employment as a farm broadcaster with the Red River Farm Network. My goal is to use my agricultural knowledge and exceptional communication skills to help the agriculture industry effectively communicate with stakeholders.