Turn tax-time turmoil into total triumph

Approaching farm tax season can feel like dreading having to clean out that disorganized barn that’s been out of sight, collecting dust for the last year.

Farm-specific tax reports

Tax time is simple with Traction Ag—just a few clicks gets you clean, CPA-ready reports. You can also securely share everything with your accountant, banker, or business partners so everyone stays on the same page without the back-and-forth.

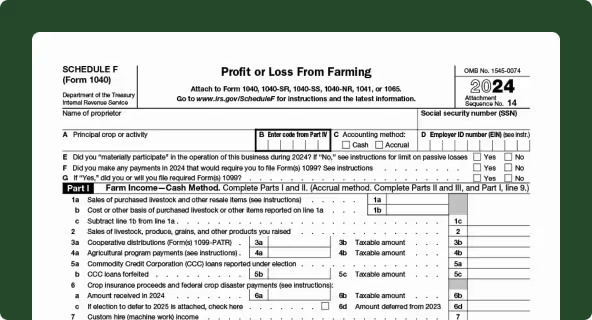

Schedule F

Quickly generate IRS-ready Schedule F reports with farm-specific expense and income categories.

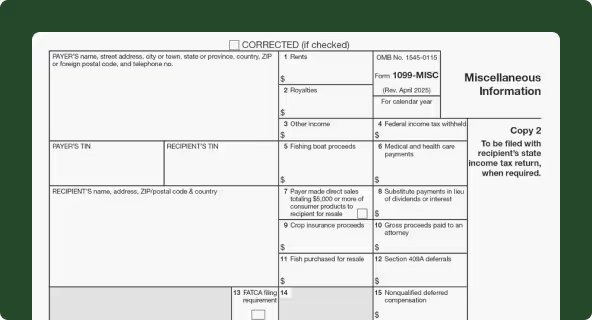

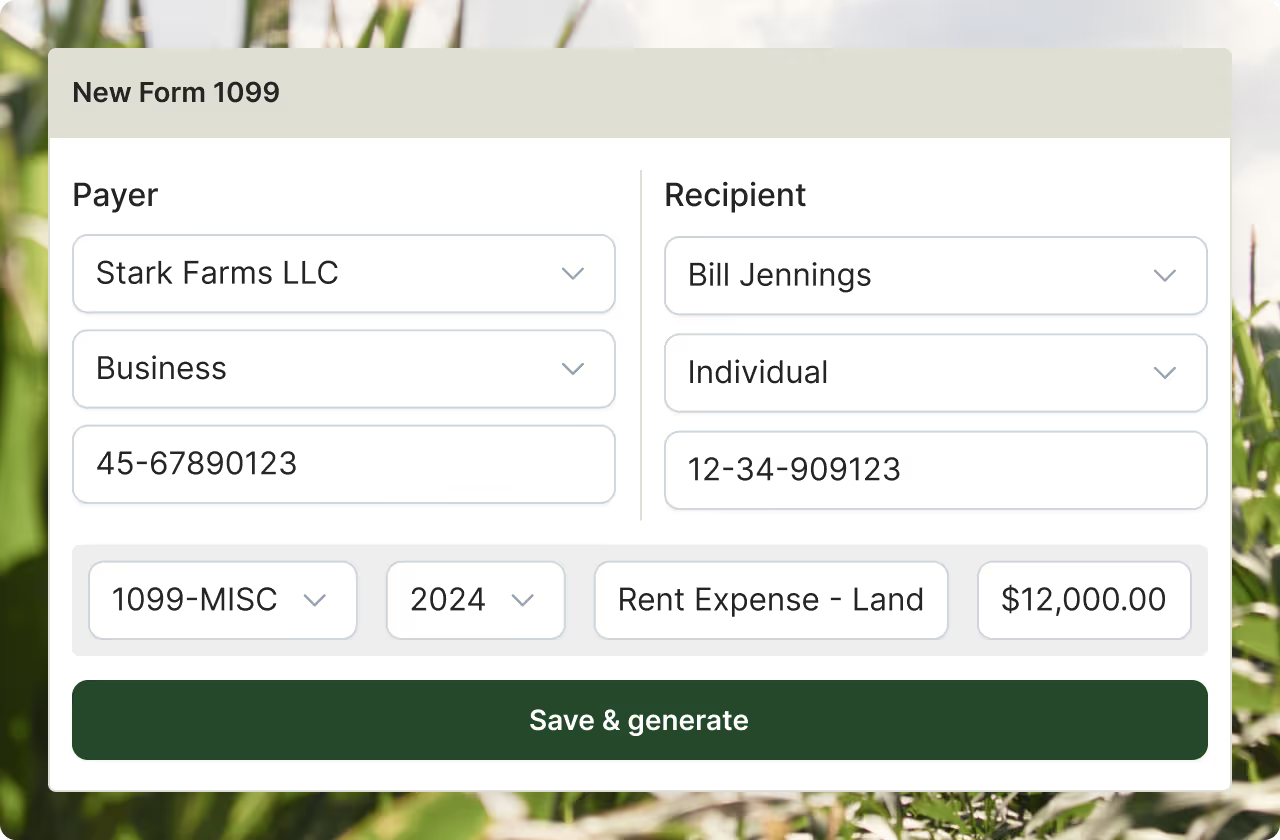

1099s

Prepare, print, and e-file 1099s in minutes—no spreadsheets or manual calculations.

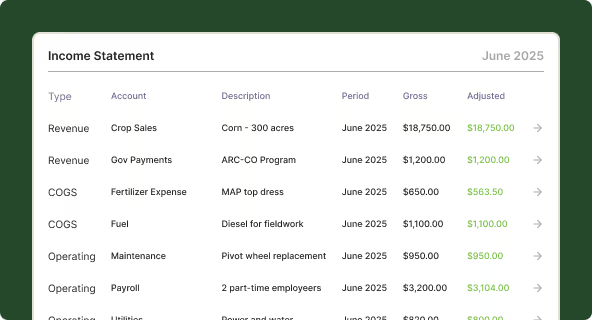

Income Statement

See profit and loss by farm, field, or entity—cash or accrual.

Detailed General Ledger

Drill into every farm transaction with a complete, sortable general ledger.

There is, in fact, a better way

Shoebox receipts. Confusing spreadsheets. Missing paperwork. That's not tax prep—that's punishment. Traction Ag is accounting built exclusively for farming. All your tax documents in one place.

Keep track of vendors

No last minute brain-wracking to think of who you owe a 1099.

Remember everything

You don’t need to find all of those old equipment receipts.

The right farm forms

Get Schedule Fs, 1099s, 941s, breakevens, and all other farm paperwork.

Never miss a beat

Track grain sales, deliveries, and stay current with transactions.

Integrate it all

Traction Ag means no more guessing, no more middlepersons, and no more paying CPAs for work you can do in minutes if you choose not to.

One system

Your income, payroll, equipment, landlords, and other expenses are already inside of Traction.

Save days’ worth of time

From tax prep to Schedule Fs, everything is just a click away.

Submit your way

You can submit your 1099s electronically or hand them to your accountant — your call.

Vendor history

You can mark vendors as 1099-eligible as you add them, avoiding the last-minute crunch.

No stress

Forget the December and January crunch times. Use a tool made just for farming.

Subscribe to our newsletter

Get the latest on what we’re building, where we're heading, and how it helps farmers.

Farm accounting that just works.

Tired of hacking workarounds in software that wasn’t built for farms? We made Traction Ag just for you.

Agape Farms in Ohio