Home | Cash Accounting: A Fundamental Starting Point for Every Farm

Cash Accounting: A Fundamental Starting Point for Every Farm

Many operators acknowledge that overseeing the farm’s finances is a crucial task, often undervalued. Despite the significant sums—potentially hundreds of thousands or even millions of dollars—circulating through the farm’s accounts annually, a fundamental question often remains: “Did the operation generate profits in the past year?”

What is Cash Accounting?

Cash accounting involves recording income and expenses in the same period when they are received or paid, contrasting with the accrual method where businesses record revenues or expenses when earned or incurred.

Generally regarded as a critical element of any business, cash accounting aligns with Peter Drucker’s wisdom, “You can’t improve what you don’t measure.” This highlights the significance of examining current and historical numbers, influencing decision-making and steering the course of your business.

Benefits of Cash Accounting

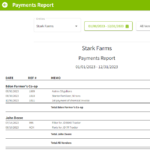

Clearer Financial Picture of Cash Flows: Cash accounting allows farming businesses to record income when received, and expenses when paid. This method provides a transparent representation of cash balances, offering a clearer and more immediate overview of the financial situation.

Easy Tax Filings: Cash-basis accounting simplifies the tax filing process for farmers. It is easier to maintain and understand compared to other accounting methods. With cash accounting, individuals or businesses can claim tax deductions for expenses paid in cash, and report taxes on revenue received in cash. Most farms keep their accounting on the cash-basis of accounting because that is how the Schedule F on the tax return is reported.

Beyond Cash Accounting

Once you are comfortable with cash accounting, you may want to delve into the accrual method. Accrual accounting transforms your accounting system from a mere compliance tracking tool into a managerial asset, enhancing visibility and enabling more informed decision-making to boost profitability. This approach addresses both simple and intricate questions such as:

- “Are we profitable?”

- “Which crops are making us money?”

- “Are we in a good working capital position?”

- “Do we have enough cash flow to cover our debts?”

- “Should we take on that ground at that price?”

Given the significant financial stakes and inherent risk in farming, having answers to these crucial questions is key. With the advanced capabilities of Traction Pro, the software takes on the substantial task of calculating both cash and accrual numbers, relieving you from heavy lifting. This valuable insight not only streamlines your financial analysis, but also increases the likelihood of ensuring a viable and profitable operation for the next generation.