Home | Why Accrual Accounting Matters for Farmers–It’s Not Just for Tax Season

Why Accrual Accounting Matters for Farmers–It’s Not Just for Tax Season

One of the most crucial, yet often overlooked responsibilities on the farm is farm business accounting. Regrettably, many operations perceive this task as a necessary evil, typically addressed only once a year before banker meetings or tax return filing.

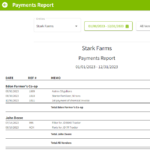

Despite its neglect, managing the farm’s finances is widely acknowledged as one of the most vital aspects of farm operations. With hundreds of thousands, if not millions, of dollars flowing through the farm’s accounts annually, a fundamental question often goes unanswered: “Did the operation make money last year?” This cannot be determined by simply checking the balance in the checkbook.

Cash vs. Accrual Accounting on the Farm

Most farms utilize cash basis accounting, aligned with the Schedule F on tax returns. Under this method, income is recorded when deposits are made, and expenses are recorded when checks are written. However, the mere comparison of deposits to checks does not necessarily indicate profitability, especially considering the complex flow of income and expenses across multiple crop cycles.

Transforming Numbers into Farming Strategy

Accrual accounting emerges as a solution to this challenge. Unlike cash basis accounting, which merely tracks compliance, accrual accounting transforms the accounting system into a managerial tool. This shift increases visibility, enabling informed decision-making to enhance profitability. It addresses crucial questions like:

- Are we profitable?

- Which crops are making us money?

- Are we in a good working capital position?

- Are we cash-flowing enough to cover our debt payments?

- Should we take on that ground at that price?

Practical Steps to Adopt Accrual Accounting in Farm Operations

Transitioning from cash to accrual accounting can be daunting for those unfamiliar with the process. Leveraging a farm accounting software such as Traction Pro is essential in helping you make the transition. The beauty with Traction is that it handles both cash and accrual methods without much extra work. And it becomes easier when you have machine data integrations like John Deere Operations Center or Climate FieldView™ that allows you to easily import field records to automatically adjust input inventories and harvested bushels.

The essence of farm sustainability lies in passing down not only the farm, but it also provides a solid financial foundation to the next generation. By placing equal emphasis on leaving a better financial position, farmers can ensure a viable and profitable operation for the future, truly embodying the concept of leaving a legacy.

accrual balance sheet farm accounting farm accounting software farm management