Home | Cash Flow in a High Interest Rate Environment

Cash Flow in a High Interest Rate Environment

Interest rates have more than doubled in the past year. Since September of 2001, U.S. farmers have operated in a low interest rate environment. During that 20+ year span, business habits and expectations of cheap money have been on cruise control. Now that the era of low-cost capital has been interrupted, better planning and computerized record-keeping is more important than ever.

Higher interest rates have many implications for a capital-intensive industry like agriculture. Practical management tactics need to change in a high interest rate environment, and strategic concerns must be considered.

Here are 5 things to keep in mind

- Cash Management It is important to be sure that the business’s cash is earning a return. If operating capital is sourced from a loan, then set up the loan as a revolving line of credit and make sure any excess cash is paid. If working capital comes from cash, then get a return on any excess funds. Money market rates, for example, are once again significant and a safe place to park cash for the short term. In either case, automate the flow of these funds through “sweep” accounts or other cash management tools. Check with your banker or lender for options available to you.

- Grain Storage Costs When short-term interest rates go from 3% to 8%, the interest cost of storing a bushel of $14 soybeans goes from $.035 per month to $.093 per month. Consider this cost when making storage and marketing decisions.

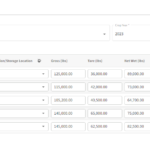

- Cash Flow

This is an obvious point, yet critical. If you borrow operating funds, your cash interest expense will be much higher. Be sure to account for this in your budgeting so that you are not surprised and have the funds to make the payments when due. - Capital Expenditures

The cost of capital has also gone up for both debt and equity capital deployed by the business. This makes any given capital investment more expensive and increases the importance of earning high returns on these investments. Many farms have been actively purchasing equipment and land, financed at lower than current rates. This gives managers the staying power to forgo purchases that are not clear-cut, high-return needs of the farm. Forgoing something that is truly needed, however, would be a mistake. Excellent cost and return analysis is the best resource for making good decisions. - Asset Values

The simple math of discounted future value means that higher interest rates, in isolation, equal lower asset values. However, no economic factor is in isolation and a myriad of other supply and demand elements will also affect agricultural asset prices. Caution is warranted.

Conclusion

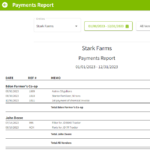

Managing higher interest rates is complex but not impossible. Consider using a farm-specific accounting software, like Traction Ag, to track your numbers. You’ll gain quick visibility into your farm’s financial position, allowing you to confidently make proactive decisions related to your profitability and equity position

-

Brian Watkins

Brian Watkins farms with his brother and nephew near Kenton, Ohio. They specialize in corn and soybean production and operate a wean-to-finish swine operation. Brian holds a BS in Ag Econ and an MBA from The Ohio State University. In addition to farming, Brian speaks and consults on the topic of farm technology adoption and value creation. He has consulted internationally on farm management with the World Bank. He is also a founder of CropZilla Software, Inc., a finance and management tool for farmers.