Prepay Expenses vs. Machinery Purchases

As the end of the year approaches, tax liability is top-of-mind — and many farms execute last-minute transactions to manage that liability. Machinery purchases can serve this tax-planning function, thanks to expensing and accelerated depreciation rules in the tax code.

For grain farms, the capacity and reliability of their equipment fleet is critical to drive profitability, especially in years with weather delays that reduce the time window for field operations. But it is still important, even in years of high income, to make machinery purchase decisions based on sound financial analysis focused on return on investment.

Equipment Purchase Plan

One element of this financial analysis is to have a written, multi-year capital replacement plan that estimates the timing of planned purchases. Individual farms will have different approaches on how long to keep tractors, planters, sprayers, combines, etc., depending on their unique size, skills, and strategy. Plans are obviously subject to change. But being intentional about the timing and amount of capital purchases, and seeing this in a multi-year setting, will help you make more strategic choices that benefit your operation in the long run.

To make good purchase decisions, you should also keep track of use, productivity, repair costs, fuel usage, and other data on every piece of equipment in the farm fleet. Having this data can help you determine return on investment for any individual machine trade decision. Several software tools can help track this data—but a good farm accounting platform is the most important.

Equipment Market Value Analysis

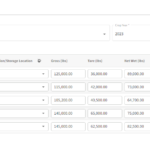

A third element to support machinery purchase and replacement decisions is an annual appraisal of the farm equipment fleet. Keeping abreast of the farm machinery market and your individual machine values helps plan the timing of replacement and purchase decisions.

Predicting the resale value of your fleet is not easy—any more than predicting the price of corn. But the first step to manage your position is basic tracking of values and price movement in a software system like Traction Ag.

Making the right decision

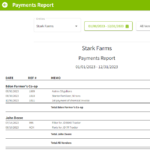

A final note: be sure to consider your working capital position. Equipment purchases are vital to a farm’s success, but they also reduce liquidity necessary to fund operations. There are other transactions that can help with tax planning—such as prepaying expenses—that do not reduce working capital. To keep tabs on working capital, you need a farm information system that enables regular, timely, and accurate financial reporting.

As always, consult your tax professional for specific rules on all tax-related activities.

-

Brian Watkins

Brian Watkins farms with his brother and nephew near Kenton, Ohio. They specialize in corn and soybean production and operate a wean-to-finish swine operation. Brian holds a BS in Ag Econ and an MBA from The Ohio State University. In addition to farming, Brian speaks and consults on the topic of farm technology adoption and value creation. He has consulted internationally on farm management with the World Bank. He is also a founder of CropZilla Software, Inc., a finance and management tool for farmers.